Working capital formula images are available. Working capital formula are a topic that is being searched for and liked by netizens today. You can Get the Working capital formula files here. Get all free vectors.

If you’re searching for working capital formula images information connected with to the working capital formula interest, you have pay a visit to the right blog. Our site always provides you with hints for seeking the highest quality video and picture content, please kindly search and locate more informative video articles and graphics that match your interests.

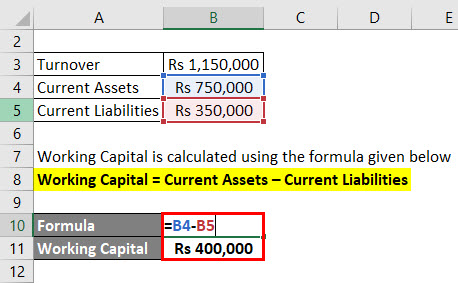

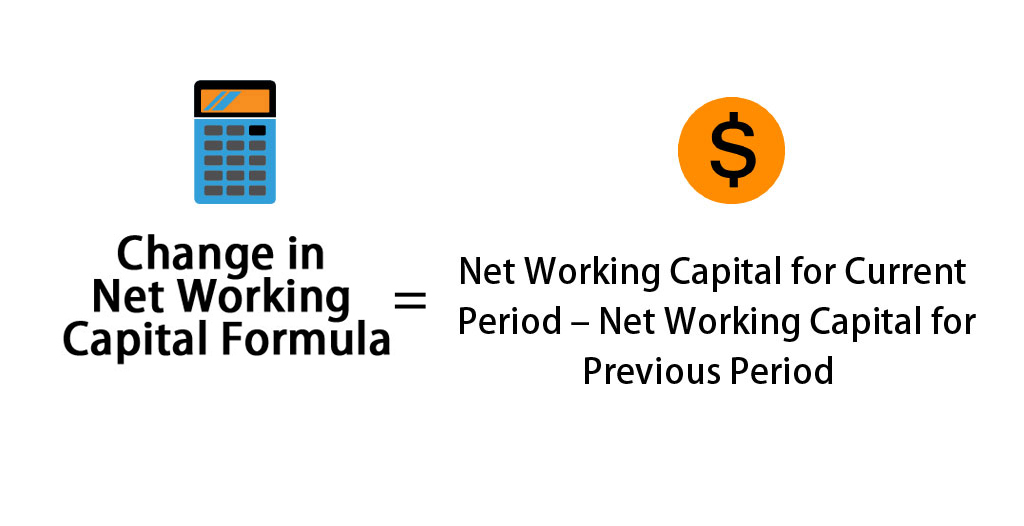

Working capital abbreviated wc is a financial metric which represents operating liquidity available to a business organization or other entity including governmental entities. Working capital current assets current liabilities. We hope this guide to the working capital formula has been helpful. Before we look at the formula lets delve into the subject of working capital. Typical current assets that are included in the net working capital calculation are cash accounts receivable inventory and short term investments.

Working Capital Formula. We hope this guide to the working capital formula has been helpful. Here is what the basic equation looks like. Along with fixed assets such as plant and equipment working capital is considered a part of operating capital. The net working capital formula is calculated by subtracting the current liabilities from the current assets.

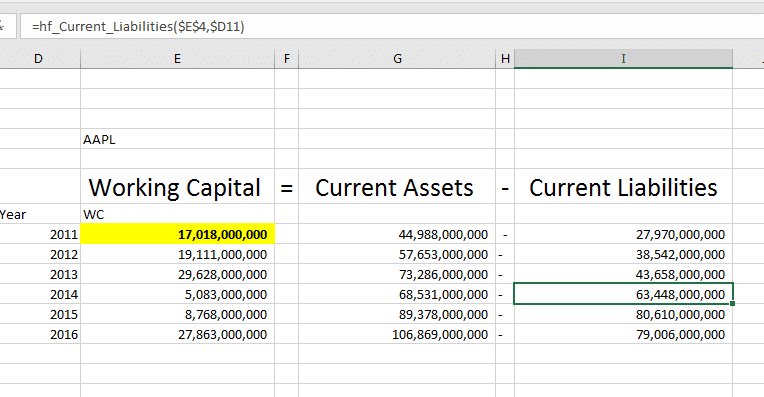

Change In Working Capital How To Interpret And Calculate In From marketxls.com

Change In Working Capital How To Interpret And Calculate In From marketxls.com

If there are excess current assets the additional resources can be spent on day to day operations. Net working capital formula. You could also calculate the working capital for each quarter and take an average of the four quarters and plug the result into the formula as average working capital. Typical current assets that are included in the net working capital calculation are cash accounts receivable inventory and short term investments. The working capital formula is used to calculate the money available to pay these short term debts. One of the major reasons behind an investors desire to analyze a companys balance sheet is that doing so lets them discover the companys working capital or current position working capital reveals a great deal about the financial condition or at least the short term liquidity position of a business.

Gross working capital is equal to current assets.

The working capital formula is used to calculate the money available to pay these short term debts. Here is what the basic equation looks like. If there are excess current assets the additional resources can be spent on day to day operations. Net working capital formula. Along with fixed assets such as plant and equipment working capital is considered a part of operating capital. Morgan and ferrari certification program designed to help anyone become a world class financial analyst.

Source: slideshare.net

Source: slideshare.net

Net working capital definition. Cfi is the official provider of the global financial modeling valuation analyst fmva fmva certification join 350600 students who work for companies like amazon jp. The ideal ratio should be 2 is to 1 in the case of manufacturing companies. Gross working capital is equal to current assets. The working capital formula is used to calculate the money available to pay these short term debts.

Source: educba.com

Source: educba.com

Working capital abbreviated wc is a financial metric which represents operating liquidity available to a business organization or other entity including governmental entities. Along with fixed assets such as plant and equipment working capital is considered a part of operating capital. Working capital in financial modeling. A working capital formula determines the financial health of the business and it suggests how the profitability can be increased in future through the current ratio which we get by dividing current asset by current liabilities. Working capital abbreviated wc is a financial metric which represents operating liquidity available to a business organization or other entity including governmental entities.

Source: excel-pmt.com

Source: excel-pmt.com

We hope this guide to the working capital formula has been helpful. You could also calculate the working capital for each quarter and take an average of the four quarters and plug the result into the formula as average working capital. We hope this guide to the working capital formula has been helpful. Working capital is crucial for any business and using the working capital formula is a simple way to see how a company is performing. One of the major reasons behind an investors desire to analyze a companys balance sheet is that doing so lets them discover the companys working capital or current position working capital reveals a great deal about the financial condition or at least the short term liquidity position of a business.

Source: educba.com

Source: educba.com

Along with fixed assets such as plant and equipment working capital is considered a part of operating capital. Typical current assets that are included in the net working capital calculation are cash accounts receivable inventory and short term investments. Working capital in financial modeling. We hope this guide to the working capital formula has been helpful. If there are excess current assets the additional resources can be spent on day to day operations.

Source: fe.training

Source: fe.training

Working capital current assets current liabilities. This is a great sign for the business and might indicate some. Before we look at the formula lets delve into the subject of working capital. We hope this guide to the working capital formula has been helpful. In simple terms net working capital nwc denotes the short terms liquidity of a company and is calculated as the difference between the total current assets and the total current liabilities.

Cfi is the official provider of the global financial modeling valuation analyst fmva fmva certification join 350600 students who work for companies like amazon jp. Net working capital definition. A working capital formula determines the financial health of the business and it suggests how the profitability can be increased in future through the current ratio which we get by dividing current asset by current liabilities. Cfi is the official provider of the global financial modeling valuation analyst fmva fmva certification join 350600 students who work for companies like amazon jp. The net working capital formula is calculated by subtracting the current liabilities from the current assets.

Source: educba.com

Source: educba.com

Working capital in financial modeling. A working capital formula determines the financial health of the business and it suggests how the profitability can be increased in future through the current ratio which we get by dividing current asset by current liabilities. The working capital formula is used to calculate the money available to pay these short term debts. Working capital current assets current liabilities. Morgan and ferrari certification program designed to help anyone become a world class financial analyst.

Source: finstanon.com

Source: finstanon.com

Working capital current assets current liabilities. Gross working capital is equal to current assets. Along with fixed assets such as plant and equipment working capital is considered a part of operating capital. The formula for calculating working capital is straightforward but it lends great insight into the short term financial health of a company. Multiply the average working.

Source: academia.edu

Source: academia.edu

Cfi is the official provider of the global financial modeling valuation analyst fmva fmva certification join 350600 students who work for companies like amazon jp. The working capital formula is used to calculate the money available to pay these short term debts. You could also calculate the working capital for each quarter and take an average of the four quarters and plug the result into the formula as average working capital. Multiply the average working. However a capital intensive company will.

Source: accaglobal.com

Source: accaglobal.com

In simple terms net working capital nwc denotes the short terms liquidity of a company and is calculated as the difference between the total current assets and the total current liabilities. Typical current assets that are included in the net working capital calculation are cash accounts receivable inventory and short term investments. Lets have a look at the formula. Morgan and ferrari certification program designed to help anyone become a world class financial analyst. Cfi is the official provider of the global financial modeling valuation analyst fmva fmva certification join 350600 students who work for companies like amazon jp.

In simple terms net working capital nwc denotes the short terms liquidity of a company and is calculated as the difference between the total current assets and the total current liabilities. The net working capital formula is calculated by subtracting the current liabilities from the current assets. We hope this guide to the working capital formula has been helpful. The ideal ratio should be 2 is to 1 in the case of manufacturing companies. Multiply the average working.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title working capital formula by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.